Newsletters

Stay informed with our curated collection of business guides, tax updates, and regulatory resources

Access comprehensive materials designed to help you navigate UAE's business landscape with confidence

.png)

December 2025

As we close out 2025, our December update highlights key UAE tax and accounting developments for a smooth year-end.It covers clarifications on e-invoicing and TIN requirements.Key VAT updates include refund time limits, input VAT recovery, and reverse charge on metal scrap.We also revisit IAS 40 to support accurate investment property reporting.

.png)

November 2025

The November FTA updates introduce key enhancements to improve compliance, including the new “My Audit” tab and the ability to download Corporate Tax Return PDFs. This edition also covers VAT P024 bad-debt relief conditions and includes a practical refresher on IAS 19 Employee Benefits for clearer, compliant financial reporting.

October 2025

This month’s edition covers key updates on the UAE’s e-invoicing rollout, including important implementation dates. We also highlight recent changes to the fees for obtaining Tax Residency Certificates (TRCs). Lastly, we provide insights into IFRS 15 and its impact on revenue recognition for businesses. Stay informed and prepared with the latest developments.

August 2025

In August, we focus on UAE Corporate Tax filing deadlines and how to stay prepared. A practical checklist covers key documents, from financial statements to transfer pricing disclosures, ensuring smooth submission. We also highlight IFRS 16 lease accounting requirements, with guidance on recognition, measurement, and CT impact.

July 2025

In July, we highlight key UAE tax updates. The FTA clarified VAT on imported services under the reverse charge with possible input recovery. Businesses should prepare for e-invoicing by July 2026. Corporate Tax rules on expense deductibility and IFRS 9’s new models for financial reporting are also emphasized. Stay proactive to ensure compliance

June 2025

In June, we highlight key UAE tax updates. Businesses receiving services from abroad should assess VAT under the reverse charge. VAT on employee health insurance may now be recoverable, and the FTA offers a penalty waiver for timely corporate tax registration. A quick guide on IAS 12 explains deferred taxes under the UAE Corporate Tax regime.

April 2025

In April, we highlight key regulatory updates for UAE businesses. Ensure your primary business activity is correctly selected on the FTA portal. Review financing arrangements for Corporate Tax interest deductions and prepare for IFRS 18 adoption in 2027. Align accounting practices with Ministerial Decision No. 84 of 2025. Early action will help businesses stay.

March 2025

In March, we highlight several important updates. The grace period for updating corporate tax records is ending on 31st March. Natural persons and sole establishments should note that the deadline for corporate tax registration is fast approaching. Additionally, there are recent updates on VAT treatment for gifts and commercial samples in the UAE.

January 2025

In Jan, we cover recent tax amendments and their impact on businesses. Learn when and how to apply for a tax assessment review, and understand VAT considerations for crypto mining activities. We also provide an important reminder on Corporate Tax (CT) registration for new entities, along with the key deadlines for CT return.

End of Year 2024

The year-end edition collates all our corporate tax updates from the past months. It provides a comprehensive overview, from CT basics and SME relief to Free Zone provisions, tax losses, transfer pricing, and key documentation requirements. Each topic is summarized with practical insights and examples. This guide serves as a handy reference to help businesses.

December 2024

This edition focuses on the importance of maintaining key corporate tax documents. We outline which records businesses must keep, from financial statements to supporting schedules. Best practices for organization, retention, and accessibility are highlighted to ensure compliance. The guide helps companies stay prepared for audits and regulatory reviews.

November 2024

This edition introduces transfer pricing and the arm’s length principle under corporate tax. We explain how transactions between related parties should be priced fairly to comply with tax regulations. Key considerations, documentation requirements, and practical implications for businesses are highlighted. The guide helps companies understand how to align intercompany transactions with regulatory standards.

October 2024

This edition covers the treatment of tax losses under corporate tax. We explain how losses can be recorded, carried forward, or transferred, with practical examples. An illustrative scenario shows how a tax loss can be applied in subsequent periods. The guide helps businesses understand how to optimize tax positions while staying compliant.

September 2024

This edition focuses on the treatment of goods distributed to and from UAE Designated Zones. We explain how distribution activities can qualify under the corporate tax rules for Free Zone Persons. The newsletter also outlines the criteria that make distribution a qualifying activity and the compliance conditions involved. A brief overview of key Designated Zones in the UAE is included to help businesses understand their scope and relevance.

July 2024

This edition introduces the corporate tax framework applicable to Qualifying Free Zone Persons. We outline the key conditions that entities must meet to maintain QFZP status and benefit from preferential tax treatment. The newsletter highlights eligible activities, compliance requirements, and the implications of failing to meet the criteria.

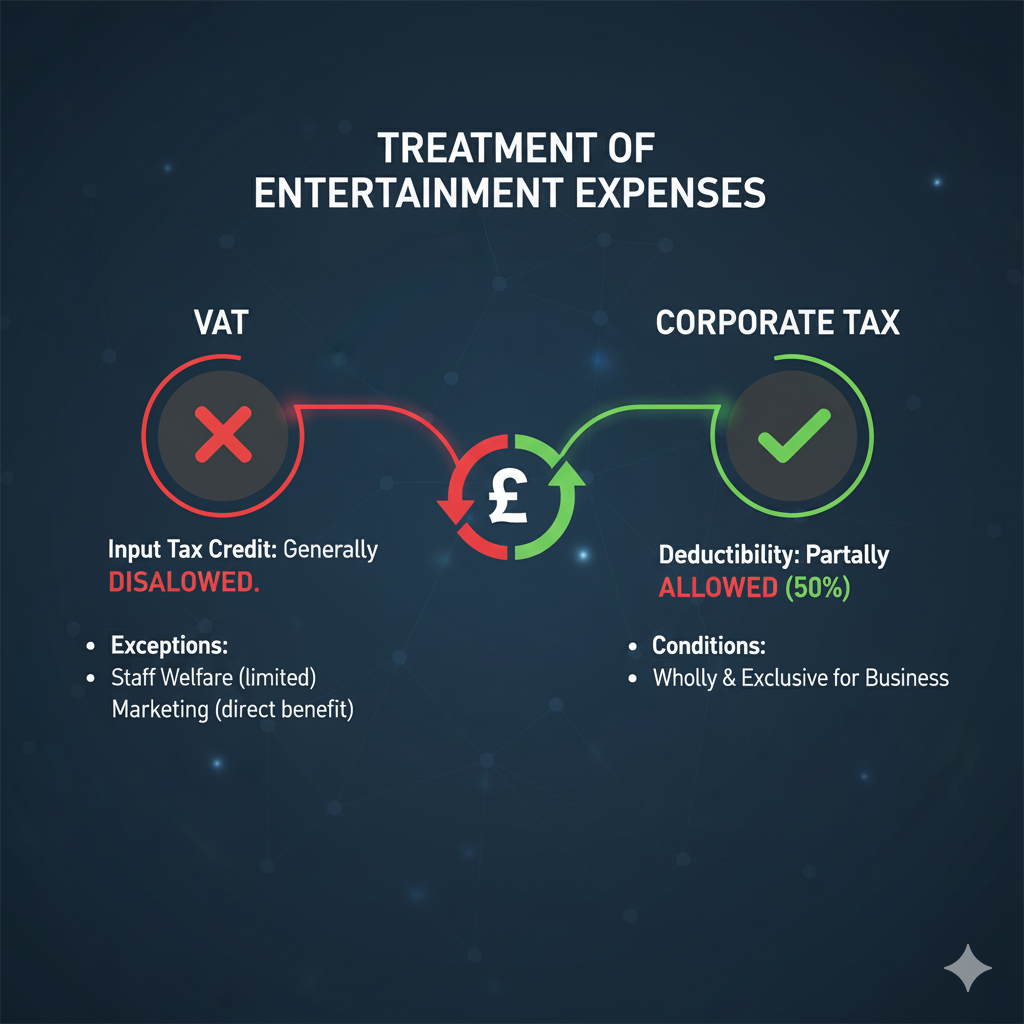

April 2024

This month, we provide a brief guide to the tax treatment of entertainment expenses. We explain what qualifies, how deductions apply under corporate tax, and the limits businesses should note. The edition also outlines the VAT rules on entertainment to help ensure proper input tax claims and compliance.

February 2024

This edition covers the key timelines for tax registration for juridical persons, non-juridical entities, and natural persons. We outline when registration is required and the essentials to prepare. We also highlight penalties for late or non-registration, helping taxpayers stay compliant with ease.

January 2024

Welcome to our very first look at the corporate tax landscape and how it shapes everyday business. This edition breaks down the essentials of CT, from key obligations to the reliefs designed to support SMEs. With rising compliance demands, understanding these fundamentals is more important than ever.